Minimum Trading Days: 0 days. 10% Return

Minimum Trading Days: 0 days. 10% Return Show Less

Prop trading, short for proprietary trading, is all about leveraging someone else’s capital to maximize your profit potential as a trader. SurgeTrader aims to take this concept to another level by providing traders access to substantial funding along with the opportunity to earn a high percentage of the profits.

But does SurgeTrader live up to its promises? Let’s take a comprehensive look at what this prop trading firm offers.

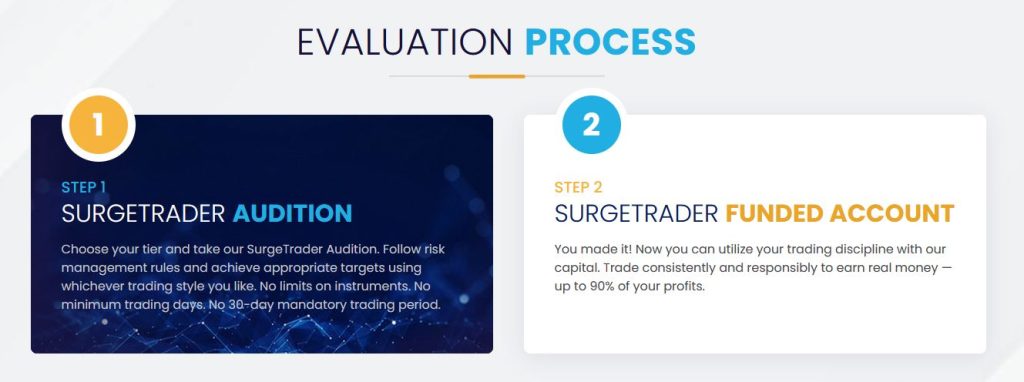

Auditioning for a Funded Account

The starting point to trade with SurgeTrader’s capital is passing their evaluation process called the SurgeTrader Audition. This audition provides an opportunity for traders to prove their skills and get funded.

Traders can choose an account tier that matches their experience level, ranging from $25,000 to $1,000,000. Each tier has an associated one-time audition fee which increases progressively. The audition simulates live trading by giving access to a demo account with specific rules.

The key rules are a daily loss limit and maximum trailing drawdown percentage. For instance, the $100,000 Seasoned tier has a 4% daily loss limit and 8% max trailing drawdown. Exceeding either benchmark disqualifies the audition.

Meeting the targets consistently allows the trader to graduate to a funded live account. SurgeTrader promises funding within 1 business day after a successful audition. No mandated trading days or monthly minimums are required.

This audition structure provides an effective risk filter for SurgeTrader while giving traders a path to quickly access substantial capital. The lack of ongoing time commitments is an advantage.

Capital and Profit Share

SurgeTrader states that the profit split can be as high as 90/10 in favor of the trader while the firm takes on the risk of losses. This ratio is far beyond the industry norm.

They offer leverage of up to 20:1 for Forex and metals trading. Higher profit splits and leverage multiples can be obtained through add-on purchases.

Traders can withdraw their profits at any time with a few clicks. No minimum withdrawal amount is specified. SurgeTrader will withdraw its share of profits proportional to the agreed split whenever the trader makes a withdrawal.

The ability to regularly access profits provides traders with financial flexibility. And the high-profit ratios create strong earning potential.

However, some traders have pointed out issues in getting timely withdrawals, indicating this is an area needing improvement. SurgeTrader needs to ensure smooth profit withdrawals to truly deliver on its promises.

Risk Parameters

While profit potential is high, SurgeTrader implements stringent risk management. The funded live accounts have preset limits.

The daily loss limit is 4-5% depending on the account tier. Crossing this benchmark leads to account disablement. There are also maximum open trade sizes linked to account equity.

SurgeTrader states that the trailing drawdown cannot exceed 8%. If this drawdown limit is reached, the account gets closed out.

These constraints ensure traders exercise effective risk management. While the profit targets are lofty, crossing the loss limits can lead to abrupt account closure.

However, some traders have complained that loss limits are arbitrarily changed or they face account closures even within the stated risk parameters. SurgeTrader needs to maintain consistency in applying the stated risk rules.

Minimum Trading Days: 0 days. 10% Return

Minimum Trading Days: 0 days. 10% Return Show Less

Trading Rules and Style with SurgeTrader

SurgeTrader says they do not impose any restrictions on trading styles, instruments, or strategies. The only key expectations are to keep losses within defined limits and consistently target profit milestones.

This flexibility allows traders to operate in their unique, personalized way. Technical trading, fundamental analysis, advanced strategies like arbitrage, etc. can all be leveraged.

SurgeTrader highlights that traders can also hold positions and trade over the weekend. This accommodates different trading timeframes.

By not prescribing trading methods, SurgeTrader empowers traders to maximize profits using their proven approaches.

However, some traders have reported facing constraints, pressure, or lack of transparency from company representatives regarding trading styles. SurgeTrader needs to stick to its promises of trading flexibility.

Platforms and Tools

SurgeTrader utilizes EightCap as its primary broker. Traders get access to the MetaTrader 4 and 5 platforms through EightCap.

The company also provides a proprietary dashboard called ST Central. This web-based dashboard allows traders to track funded accounts, monitor performance metrics, access support, and more.

ST Central enables organized account management across multiple funded accounts. Integration with EightCap’s platforms provides a comprehensive trading experience.

However, some traders have experienced issues with getting timely support for platform and technology problems. SurgeTrader needs to bolster its client technology support to provide seamless trading.

Credibility and Reviews

SurgeTrader is owned by Valo Holdings, a company that operates multiple fintech brands. This provides an added degree of legitimacy.

Industry recognition has also been garnered. Benzinga awarded SurgeTrader the title of Best Overall Prop Firm for 2023. It was also named Best Prop Trading Firm for 2022 by the Traders Union.

Reviews on third-party websites like TrustPilot reaffirm SurgeTrader’s positive reputation, although some negative feedback exists. Overall, the company seems to have built credibility.

But a deeper look at reviews shows repeated complaints about difficulty withdrawing profits, inconsistent rule application, and lack of support. While awards establish credibility, SurgeTrader needs to improve in key operational areas to truly earn trust.

Minimum Trading Days: 0 days. 10% Return

Minimum Trading Days: 0 days. 10% Return Show Less

Final Verdict

For skilled traders seeking to drastically boost their profit potential, SurgeTrader presents an alluring opportunity with funded accounts, high-profit splits, and no restrictions. The company has structured a path to access substantial capital quickly.

However, traders must consistently abide by strict risk limits and trading rules to maintain account access. The high pace of earnings has to be carefully balanced with stringent loss prevention.