If you are a futures day trader with dreams of making it big in the markets, today we delve into an exciting program that could be your gateway to unparalleled success: OneUp Trader. Let’s unpack the claims and see if this program genuinely holds the key to unlock your trading potential.

OneUp Trader claims to be that steadfast partner for aspiring traders, providing them with a platform that not only offers substantial funding but also integrates streamlined processes and an encouraging community. With numerous funded trader programs emerging across the market, OneUp Trader seeks to distinguish itself by emphasizing simplicity, transparency, and trader empowerment. This article will delve into OneUp Trader’s offerings, dissecting its funded trader program, evaluation process, and the tools it provides to help traders chart their course in the financial markets.

Streamlined Path to Funded Accounts

OneUp Trader eliminates the convoluted evaluation hoops. Instead, it offers a 1-Step Evaluation that filters through your trading prowess and if successful, grants you access to futures funded accounts. This is especially beneficial for day traders who want to prove their mettle without losing themselves in the labyrinth of a complex evaluation process.

However, be cautious. While simplicity is king, make sure you understand what the evaluation entails. Preparation is still key.

Farewell to Hidden Costs

Trading without the constant worry of hidden costs nibbling into your profits can be a breath of fresh air. OneUp Trader commits to no data or hidden fees, which means you can focus on what you do best – trading. Day traders, often involved in multiple transactions, will find this feature incredibly beneficial for their net returns.

Support When You Need It

OneUp Trader has done a commendable job with their 24/7 customer service. In the whirlwind world of trading, having a support system at your fingertips can make all the difference. They are just an email, chat, or phone call away.

Range of Funded Trading Accounts

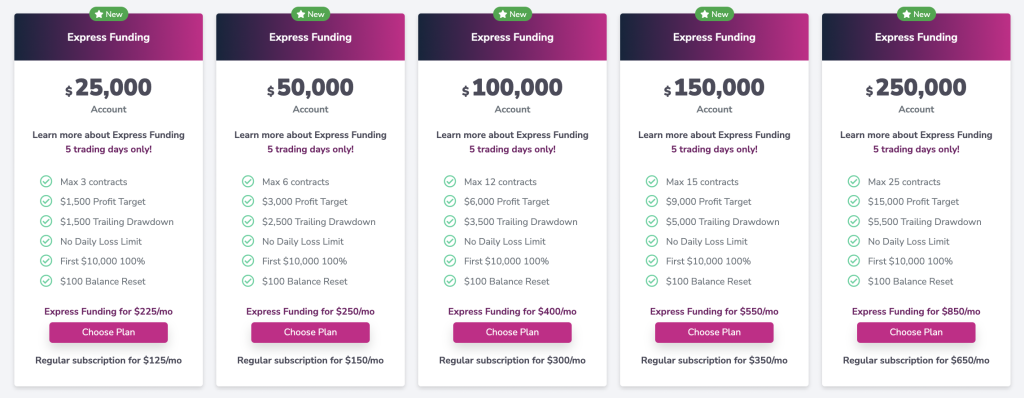

What’s your flavor? Whether you are a novice or an experienced trader, OneUp Trader offers a spectrum of funded trading accounts from $25,000 to $250,000. Each comes with its unique features allowing you to align your trading strategies with your ambitions.

A Community That Has Your Back

The power of camaraderie in trading is often understated. OneUp Trader’s private community of traders could be a goldmine for learning, sharing insights, and even building long-lasting connections. This is particularly important for those who are new to futures day trading and are seeking mentorship and guidance.

Express Funding offered by OneUp

In the ever-evolving domain of trading, staying adaptable and having the ability to recover from setbacks is indispensable. OneUp Trader, in its endeavors to support the trading community, offers a program called Express Funding. This program is tailored specifically for traders who have had the experience of being funded but have faced account termination. Express Funding serves as a second chance, affording these traders an opportunity to prove themselves once again and regain their funded trader status.

One of the salient features of the Express Funding program is its expedited evaluation period. Unlike the regular evaluation process, traders who are eligible for Express Funding can complete their evaluation in just five trading days. This is particularly beneficial for those who have previously demonstrated their trading acumen and need to re-embark on some of the evaluation processes.

The cost associated with participating in Express Funding is a monthly subscription fee, which is contingent upon the size of the account that the trader selects. It’s important to note that the subscription billing recurs every 30 days.

When it comes to the rules and parameters of the Express Funding account, they essentially mirror those of a regular Evaluation account. However, the critical distinction lies in the accelerated completion timeframe of five trading days.

Key Aspects of Express Funding:

- Traders are required to trade a minimum of five days to be eligible for placement with funding partners. The trading window is from 5 PM CT until 3:15 PM CT on trading days, excluding holidays and weekends. All positions must be closed by 3:15 PM CT.

- Various futures contracts are available for trading.

- There is a maximum position size, determined by the chosen account size. This represents the maximum allowable open positions across all products at any given time.

- Traders must achieve a specific profit target based on the chosen account size.

- Consistency is essential, as traders need to exhibit a consistent trading pattern. To meet the consistency requirement, they must have three other best trading days’ net profits equal to or exceeding 80% of their largest day’s net profit.

- The trailing drawdown is a limit that the Account Balance should not reach or exceed. It moves with the account balance. Traders who hit the trailing drawdown can reset their account for $100.

- Traders can only have one Express Funding account at a time, but can be funded on up to three accounts using different email addresses.

- Express Funding can be accessed a maximum of three times within a 30-day calendar period.

- If a subscription renews and the account hits the trailing drawdown or violates an evaluation rule, the trader must reset the account for $100 to continue trading.

Are There Any Downsides?

While the program seems to be packed with features, a critical point to consider is the financial commitment after the evaluation phase. Make sure to meticulously analyze their terms and conditions. Besides, while their 1-Step Evaluation is marketed heavily, it might lack the depth needed for some traders.

Trading with Confidence: Your Future Awaits

In conclusion, OneUp Trader, as per its claims, appears to be an interesting proposition for individuals looking to navigate the complex world of trading. With its extensive funding options, simplistic evaluation process, transparent goals, and an array of trading tools and resources, it tries to position itself as an ideal partner for both budding and seasoned traders. However, like with any investment or venture, it’s crucial for individuals to conduct thorough research and perhaps even test the waters through the trial before fully committing. Trading is a high-risk endeavor, and while a platform like OneUp Trader may provide the tools and resources, it’s ultimately the trader’s acumen and strategies that will determine their success.

FAQ

- What is OneUp Trader and how can it benefit aspiring traders?

- OneUp Trader is a platform that offers aspiring traders the opportunity to prove their trading skills through an evaluation process. If successful, they receive a funded trading account. This allows individuals to trade without risking their own capital and to benefit from the expertise and resources of an established trading community.

- How does the OneUp Trader evaluation process work for getting a funded trading account?

- The OneUp Trader evaluation process requires traders to enroll in a performance evaluation account where they trade virtual funds under specific rules. If they meet the profit targets and abide by the risk management rules over a defined period, they become eligible for a funded trading account.

- What are the fees and costs associated with using OneUp Trader’s services?

- OneUp Trader charges a monthly subscription fee for the evaluation account. The fee varies depending on the size of the account chosen. There are no additional hidden fees. However, if a trader needs to reset the account due to a breach of rules, there is an associated reset fee.

- What are the essential trading rules and guidelines to follow on OneUp Trader?

- Traders need to adhere to specific daily loss limits, meet profit targets, and manage trailing drawdowns. Additionally, traders must trade a minimum number of days and comply with the maximum position sizes. Trading hours are also restricted and all positions must be closed by a specific time.

- Can you regain a funded trader status with OneUp Trader’s Express Funding program?

- Yes, with OneUp Trader’s Express Funding program, traders who have previously received a funded account but faced termination can regain their funded status through an accelerated evaluation process.

- How does OneUp Trader’s trailing drawdown work and why is it important for traders?

- Trailing drawdown is a threshold that a trader’s account balance must not hit or exceed. It moves up as the account balance increases, ensuring that traders don’t give back all their profits. It is crucial for risk management and protects the capital.

- What trading products and instruments are available for trading on OneUp Trader?

- OneUp Trader allows users to trade various futures contracts. This includes indices, commodities, and currencies. It’s important for traders to be aware of the specific products permitted as not all futures contracts may be available for trading.